This industry guide is prepared to assist you in understanding goods and services tax and its implications on the recovery of input tax. HISTORY OF GST IN MALAYSIA.

Gst Malaysia Section 1 What Is Gst Klm Group Accounting Company Secretarial Taxation Audit Kuala Lumpur

In order to reverse the negative amount from column 5b to 6b you need to pass the following journal entry.

. GST in Malaysia will be implemented on 1 April 2015 as announced by the. GST will not be imposed on piped water and first 200 units of electricity per month for domestic consumers and. There are some exceptions to the 60-day rule.

Negative amount shown in GST-03. A refund of the input tax is paid to businesses where the input tax credit is greater than the output tax. Enter the last date of the GST period eg 30 June.

Every taxable person has to account GST based on time of supply under section -- of GST Act 201X on either the. In Malaysias Budget 2014 speech the implementation of Goods and Service Tax GST was perhaps the hottest topic. A recent decision by Malaysias High Court in LDMSB vKetua Pengarah Kastam Anor 17 June 2021 unreported as yet allowed the taxpayer LDMSB a refund of an input tax credit ITC in relation to the former goods and services tax GST as a refund of tax overpaid or erroneously paid The High Court decision is potentially controversial as claiming an ITC.

The introduction of the six percent GST in Malaysia from April 1 2015 will bring forth radical changes to the Malaysian tax landscape. The tax authority will expect to see that the bank charges are considered purchases in the GAF that is generated. When to charge 0 GST Zero-rate When is GST not charged.

GST on Output Output Tax Claim Input Tax. Many domestically consumed items such as fresh foods water and electricity are zero-rated while some supplies s. The amendment to the final GST-03 Return should be made would be allowable in the following situations subject to meeting conditions.

Create 2 entries first entry select as Purchase P. Sales tax and service tax will be abolished. The GST registered businesses may recover the GST paid via the credit system ie.

Under GST most of the goods and services except basic necessities will be charged a tax rate of 6 at every stage of the supply. Malaysias goods and services tax GST was replaced by the sales tax and services tax but there are still transitional GST issues that may need to be resolved. What is the treatment when the GST rate is standard.

Be aware of the transaction date you enter. In order to help manufacturers manage the effects of GST the Malaysian government has created the following schemes. Input tax credit is not allowable for making exempt supplies.

For more information regarding the change and guide please refer to. This study examines the impact of the GST on the Malaysian economy from three major perspectives. Accounting of output tax on tax invoice issued on or after 1 September 2018 for taxable.

GST is suspended on the importation of goods made by a ATS holder. Offsetting the input tax against the output tax from the Royal Malaysian Customs Department RMCD. Accounting of output tax on tax invoice issued on or after 1 September 2018 for taxable supplies made during the GST era.

27 Standard-rated Zero-rated Exempted Out of Scope GST Rate Claimable 6 0 --GST MECHANISM CONTD HOW GST WORKS. A date of tax invoice b date of delivery. Yes at standard rated 0.

Both the Malaysia GST and Singapore GST are broadly. In Malaysia the GST has a broad base and is imposed on about 40000 goods and services. According to the GST guides no GST adjustment is allowed to be made after 31 August 2020.

However the SST has a narrow base and only captures about 40 of the. STANDARD RATED 6 28. Per Malaysia GST regulations GST will be applied to the bank charge.

What is the GST treatment and do I need to account for output tax on the free services given. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. Amendments to the final GST-03 return if any must be made by 31 August 2020.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. If you are unable to export the goods or obtain all documents within the 60-day period you will have to standard-rate the supply of goods and charge GST. GST GUIDE FOR INPUT TAX CREDIT 250413 1 INTRODUCTION 1.

The Customs Department will refund the net difference to the manufacturer if the input tax is larger than the output tax payable. The existing standard rate for GST effective from 1 April 2015 is 6. GST which is also known as value added tax in other countries is a tax.

To be introduced in April 2015 it will replace Malaysias Sales tax 10 and Service tax 6. GENERAL OPERATIONS OF GOODS AND SERVICES TAX GST 2. Goods and services tax GST has been a controversial topic in Malaysia when it was first implemented.

Overview of Goods and Services Tax GST in Malaysia. Yes if the purchase was made 3 months before the tourist departs from Malaysia. GST provided for a multi-staged tax collection system in which every taxable.

The much anticipated Sales Tax Act 2018 and the Service Tax Act 2018commonly referred to as SST was rolled out on 1 September 2018 together with their respective subsidiary legislations to replace the previous Goods and Services Tax Act 2014 GST. Charging GST Output Tax When to Charge Goods and Services Tax GST GST is charged on all sales of goods and services made in Singapore except for exported goods international services and exempt supplies. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

Special Approved Toll Manufacturer Scheme ATMS. Currently Sales tax and service tax rates are 10 and 6 respectively. Goods and Services Tax GST Malaysia will be implemented with effective from 1 April 2015 and GST rate is fixed at 6 per cent.

In accordance with amendments made to Section 41 of the Goods and Services Tax Act 2014 with effect from 112016 failure to pay the amount of goods and services tax to be paid within the period specified will be penalized. Journal entry to reverse the negative amount in GST-03. Malaysia GST Reduced to Zero.

The bank will provide a GST invoice to you and you can claim the GST input tax. Imposition of penalties will start for the taxable period for which tax payments are due and payable on 3112016. When exporting goods you have up to 60 days from the time of supply to export the goods and collate the required export documents.

The GST also known as value added tax VAT in some countries is not a new concept of taxation as other countries in the region introduced GSTVAT years ago.

Goods And Services Tax Gst Malaysia For Manufacturing Sector

What Is Gst Tax Stock Market Accounting Services Goods And Services

Gst Better Than Sst Say Experts

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

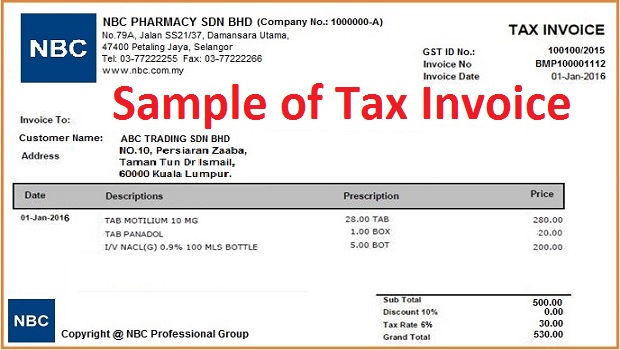

Professional Tax Invoice Template Example Invoice Template Nz For Tax Invoicing Purpose When You Are Making Your Invoice Template Templates Invoice Example

How Gst Affects Smes From Registration To Daily Operations Benefit Registration

Free Resources Archives Goods Services Tax Gst Malaysia Nbc Group

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0